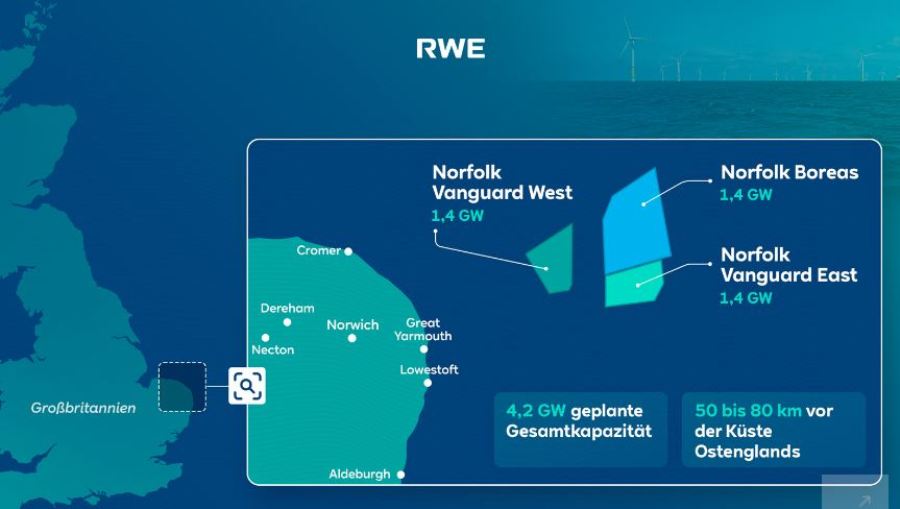

RWE, one of the world’s leading offshore wind companies, will acquire the UK Norfolk Offshore Wind Zone portfolio from Vattenfall. The portfolio comprises three offshore wind development projects off the east coast of England – Norfolk Vanguard West, Norfolk Vanguard East and Norfolk Boreas.

The three projects, each with a planned capacity of 1.4 gigawatts (GW), are located 50 to 80 kilometers off the coast of Norfolk in East Anglia. This area is one of the world’s largest and most attractive areas for offshore wind. After 13 years of development, the three development projects have already secured seabed rights, grid connections, Development Consent Orders and all other key permits. The Norfolk Vanguard West and Norfolk Vanguard East projects are most advanced, having secured the procurement of most key components. The next milestone in the development of these two projects is to secure a Contract for Difference (CfD) in one of the upcoming auction rounds. RWE will resume the development of the Norfolk Boreas project, which was previously halted. All three Norfolk projects are expected to be commissioned in this decade.

At its Capital Markets Day 2023, RWE announced plans to invest €55 billion worldwide in the years 2024 to 2030, to grow its green portfolio to more than 65 GW by 2030. This is backed by RWE’s extensive development pipeline and its strong financial headroom. The Norfolk portfolio will be part of RWE’s Growing Green investment and growth program. Its acquisition will add three highly attractive projects to RWE’s project pipeline. RWE’s net capacity target to add more than 30 GW by 2030 remains unchanged.

The agreed purchase price to acquire the Vattenfall portfolio is based on an enterprise value of £963 million. The majority of the purchase price relates to expenses spent to date. Closing of the transaction is subject to approval by The Crown Estate and regulatory approvals and is expected in Q1 2024.